Modernizing Banking: Overcoming the Legacy System Challenge

A total bank transformation – particularly the migration from legacy systems to modern SAP platforms – is one of the most strategically important steps for financial institutions. Many banks still operate with historically grown core banking systems that are heterogeneous, difficult to maintain, and technologically outdated. These legacy environments hinder innovation, drive high operating costs, and pose risks in terms of stability and compliance.

By moving to a consolidated, service-oriented SAP architecture – for example, based on SAP S/4HANA and SAP Banking Services – banks can establish a unified data foundation, real-time capabilities, and standardized business processes. This transformation enables greater agility, faster time-to-market, improved regulatory control, and seamless integration of modern technologies such as AI, Cloud, and Open Banking.

Importantly, total bank transformation is not just an IT project. It is a fundamental restructuring of systems, organization, and processes – laying the foundation for the digital business models of the future.

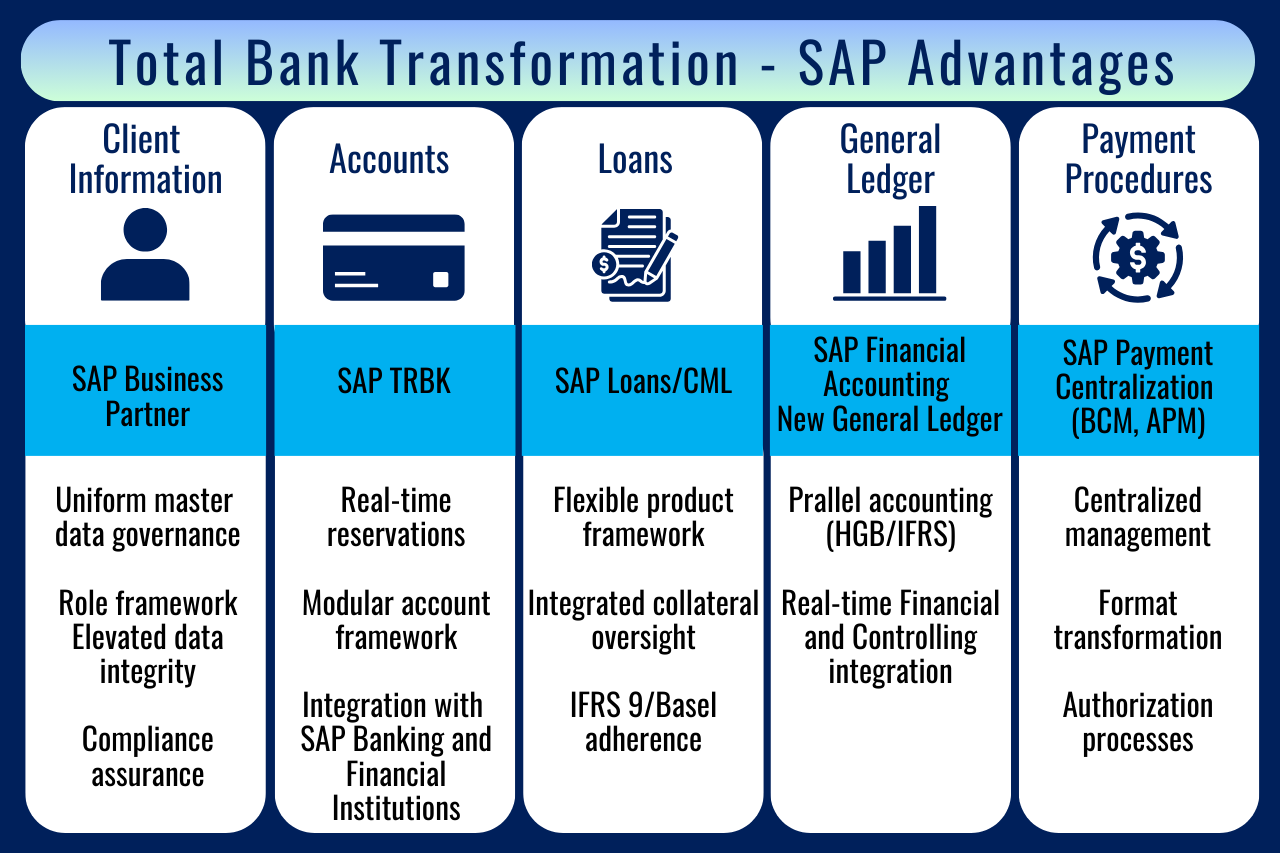

Key SAP Components in a Bank Transformation

The SAP Business Partner model provides a consistent data framework for individuals and organizations.

Benefits:

- Centralized master data management without redundancies

- Improved data quality with duplicate checks and validation rules

- Full compliance with regulations (e.g., GDPR, MaRisk)

- Deep integration into SAP S/4HANA and banking modules

- Flexible extensibility for customer-specific roles and attributes

SAP Transactional Banking (TRBK)

SAP TRBK forms the account management framework within SAP Banking Services.

Benefits:

- Modular and future-proof account model

- Real-time postings and transactions

- Seamless integration with payments, general ledger, and business partner data

- Multi-currency and multi-bank support

- Strategic backbone of modern core banking architectures

SAP Loans Management (CML)

The specialized SAP module for managing all loan products.

Benefits:

- Standardized product model for mortgages, installment, and investment loans

- Flexible contract configuration without custom development

- Regulatory compliance with IFRS9 and Basel III

- Integration with BP, FI, and TRBK

- Automation via workflows and third-party system integration

SAP New General Ledger (FI New GL)

A modern foundation for financial accounting and regulatory reporting.

Benefits:

- Parallel accounting (e.g., local GAAP and IFRS) without redundant postings

- Segment reporting & profit center accounting

- Real-time integration with Controlling (CO)

- Extended document structures for improved transparency

- Consistent reporting platform for supervisory and regulatory requirements

SAP Payment Centralization

Centralized payment processing with SAP Bank Communication Management (BCM) and Advanced Payment Management (APM).

Benefits:

- Unified management of payment flows across the enterprise

- Group-wide transparency over cashflows and bank relationships

- Integrated approval workflows with four-eyes principle

- Automated support for payment formats (ISO 20022, SEPA, SWIFT)

- Real-time monitoring and payment tracking

- Direct connectivity to banks via SAP Multi-Bank Connectivity (MBC)

Conclusion

A total bank transformation with SAP creates strategic, architectural, and operational value:

- Unified and high-quality data foundation

- Seamless end-to-end process integration

- Full regulatory compliance

- Real-time capability and automation

- Scalable architecture for innovation and growth

With SAP, banks not only modernize their IT, but also establish a future-proof platform for digital business models, agile product innovation, and sustainable compliance.

Why alseda Consulting is the Right Partner

At alseda consulting, we bring extensive project experience and deep expertise in SAP Banking transformations. Our consultants combine industry knowledge with technical know-how in SAP Banking Services, TRBK, Loans Management/CML, FI New GL, and Payment Centralization.

We support banks throughout the entire transformation journey – from strategic target design and architecture planning to implementation and migration. With agile methodologies, proven templates, and risk-aware migration strategies, we ensure that transformations are structured, efficient, and value-driven – from initial kick-off to stable production.

alseda stands for competence, reliability, and innovation – building with you a sustainable banking architecture on SAP that is ready for the future.

Would you like to strategically optimize your digital transformation?

Contact us for more information at infomail(at)alseda.com