Instant Credit

FACT SHEET

More information about Instant Credit

DIGITAL FUNDING FOR SPONTANEOUS DECISIONS

Next-day-delivery is standard for online shopping and shortening the delivery time is still in progress. We will also experience further accelerations in our mobile society in many other social processes. Therefore, it will be necessary the availability of liquidity adapt to changing conditions continuously. In addition to the convenient availability at all times, the financing has also to fulfil the requirements for security and low costs. Existing options can usually not fulfil all the necessary requirements at the same time. Credit cards are expensive, but established lending is not always available, and payment is too slow.

AUTOMATION OF THE LENDING PROCESS

Capturing a loan request online or with an app is certainly not one of the achievements of digitization, because this possibility existed for years. Rather, digitization should ensure automation in the overall process (straight-through processing) and also run in real-time. Capturing a loan request with an app just to get it online and wait several days for the loan to be paid out is no longer acceptable.

IMMEDIATE PAYING OUT

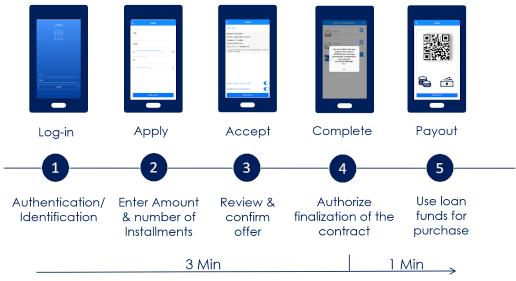

alseda and b²tec set themselves the goal of developing a credit process that only takes a few minutes from loan request to payment. In addition to the know-how of the two companies in transaction banking for optimizing the back-end processes, the latest technologies were also used to link the functional components. The result is a modular credit process with end-to-end automation and processing in real time.

EASE OF USE

The app is intuitive and self-explanatory. The loan request can be made in just a few clicks. Annoying typing in of data is avoided by selection boxes and sliders.

TRANSPARENCY

What is the next step? The customer is informed of the current status of the processing by push messages. For the financial service provider, every processing step is comprehensible in detail.

PAYOUT IN REAL TIME

Spontaneous buying decisions require quick response capability. If the customer accepts the loan offer, the credit will be transferred to his account in seconds via instant payment.

AUTOMATION

In the standard case, no manual work in the back office is required. The solution offers straight-thru processing from the app on the smartphone to the mapping in the ERP back-end system.

MODULAR CONSTRUCTION

A modular structure of the overall solution was chosen for flexible integration into existing application architectures and expandability with new FinTech services.

MANAGEMENT COCKPIT

With the latest technologies, management evaluations are available in real time. This enables a dynamic control of the conditions according to the demand in the market.

DIGITAL FUNDING AND PAYMENT IN 5 STEPS

RANGE OF FUNCTIONS

- Entry of the loan request via mobile devices (via app or API)

- Central process control of all transactions via an integrated module

- Automated credit check with external credit agencies (e.g. Schufa)

- Credit-dependent condition design

- Automated credit investment with payment due at the same time

- Immediate initiation of payment using SEPA Instant Payment

- Management of business accounts and customer information

- Mobile management cockpit to monitor the entire process