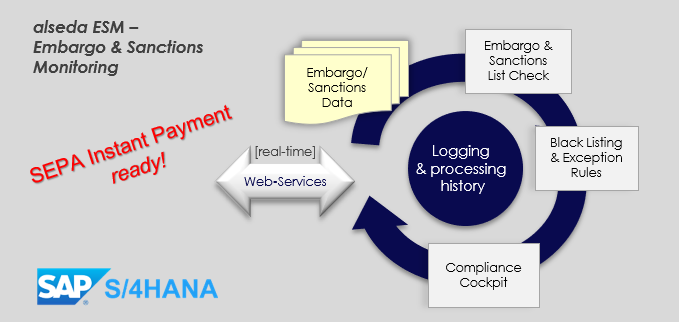

ESM – Embargo & Sanctions Monitoring

FACT SHEET

More information about alseda's ESM solution.

Secure compliance – check against embargo and sanctions lists

alseda ESM is a software solution for the identification of individuals and organizations which are subject to sanctions. The ESM solution detects and highlights transactions initiated by or in favour of individuals and organizations listed in the embargo and sanction lists. Business Partner data can also be checked in real-time for compliance with national, international and internal sanctions lists.

National and international sanctions lists

To meet global requirements, the alseda ESM solution provides interfaces to facilitate the integration of various national and international lists, including:

- BAFA (Federal Office of Economics and Export Control)

- Consolidated list of persons, groups and entities subject to EU financial sanctions (CFSP)

- U.S. Department of the Treasury: The office of Foreign Assets Control (OFAC)

- Japanese METI list (Ministry of Economy, Trade and Industry)

Additional sanctions lists can be accessed via the provided web services and automatically processed.

It is possible to define rules which govern the use of special sanction lists at a transaction level, e.g. for checking all USD payments automatically against U.S. OFAC lists.

Automated monitoring of payment transactions

All transactions are examined in terms of their real-time sender and receiver data for possible use in connection with sanctioned individuals or organizations. The alseda ESM solution checks whether the payment information matches entries in the relevant sanctions lists (e.g. name or aliases of terrorists, criminals and terrorist organizations).

Transactions deemed to be suspicious because of matching information on the sanctions lists, are characterized by the solution in the “Compliance cockpit”. The result is returned in the source system with a status of “Not ok”. Non-suspicious transactions are immediately released, returned as checked and processed normally.

Efficient search and edit

alseda ESM solution does not just identify exact matches with entries in the sanctions lists. Swapped name constituents, abbreviations, substitutions, amended spellings and deletions can also be detected with the “fuzzy search” function.

Regarding rules and fine adjustments (e.g. the use of positive lists of persons and individual terms excluded from the sanctions list checks), the number of false results can be greatly reduced. The user can thus focus on the processing of truly relevant search results.

Within the “Compliance cockpit”, the high-lighted transactions can be manually compared with the corresponding entry from the sanctions list and checked. The corresponding decisions can be documented for each transaction directly in the alseda ESM solution. If a transaction is initially marked with the status “Waiting”, it can subsequently be manually released for further processing.

Payment and address formats

alseda ESM solution accommodates complete processing of payment transaction formats for SEPA (pain, pacs) and SWIFT (MT & MX).

In addition, all transactions from the SAP PE – Payment Engine (meta-format) can be directly processed.

Other payment formats, such as Multi-cash or other national formats, can also be processed via the appropriate format converters.

In addition, the payment transactions and business partner information (name, address) can pass and automatically check against the embargo and sanctions lists (e.g. when opening an account).

Audit-proof logging and history

alseda ESM solution supports an audit trail of all checks, operations and decisions linked to a transaction. This provides a detailed history of the checks performed, the decisions made and the associated justifications for processing a transaction.

Standard SAP archiving objects are utilized to archive the logs.

alseda ESM: The advantages at a glance

- Real-time examination of all transactions’ sender and receiver data against national and international sanctions lists: Germany, Europe, USA, Japan

- Processing of SEPA (SCT, SDD, R-transactions) and SWIFT (MT, MX) payments, business partner information (names, addresses), and all payments directly from the SAP PE – Payment Engine.

- Comprehensive search mechanisms with exact and fuzzy search for the identification of sanctioned individuals and organizations.

- Conspicuous sender and receiver data of a transaction are shown in the “Compliance cockpit” and can be processed directly.

- Customized validation rules and positive lists (white-listing) reduce persistent misidentification and minimize the overhead associated with result checking.

- History logs and audit trails for all technical and manual processes.